Amid Rising Prices, There Is a Responsibility To Fight Global Food Insecurity

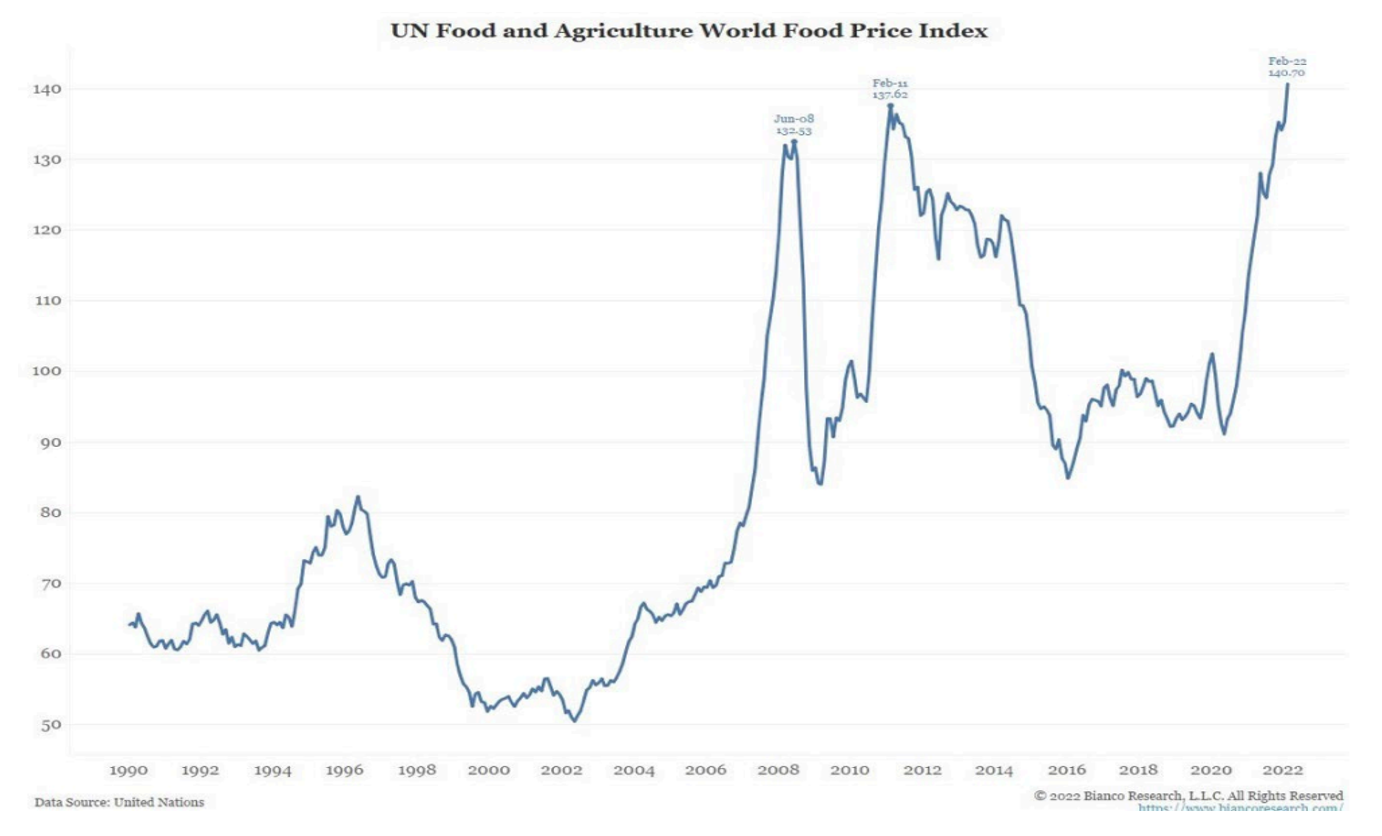

Food prices have reached record levels across the world. This rapid increase shows no sign of slowing and could further threaten the ability of millions of people to feed themselves and their families. The world needs to act quickly and work together to help these people and protect their basic right to food.

Russia’s war against Ukraine has exacerbated rising prices and is imperiling the global food supply. To put this situation in perspective, Ukraine exports 20-30 metric tons of wheat a year, representing 10%-15% of world wheat exports. Russia sells another 45 metric tons, or about 30% of global exports. It’s clear that a prolonged conflict could have a devastating effect on wheat supply and contribute to a global food catastrophe. Unfortunately, the greatest impact will be on those who have the least. People in developing countries and those with lower incomes in developed countries will further struggle to put food on the table.

In summary, a “perfect storm” of events — including increased energy prices, supply chain disruptions and Russia’s war on Ukraine — is creating a problem that needs to be addressed now. For context, the last time food prices increased to this degree was in 2007 and the first half of 2008. In fact, food prices hit a 34-year high in December 2007. A few years later, elevated costs for food led to the Arab Spring anti-government protests, uprisings and armed rebellions that impacted Northern Africa and the Middle East in the early 2010s.

We are now living in a time that will be long remembered in human history. Russia will be judged by the world for its invasion of Ukraine, but history will also judge the rest of us for how we respond to this pending food crisis, as 2 billion people could soon be at risk of not knowing where their next meal is coming from. There are ways we can and should act. For instance, we can donate food, money and time to help those in need. We can also invest in funds that seek to solve the problem.

At Faith Investor Services, we encourage you to take both courses of action. Several reputable organizations are currently accepting donations for their humanitarian efforts in Ukraine. This group includes the Knights of Columbus, which has established a Ukraine Solidarity Fund. From an investment standpoint, the FIS Biblically Responsible Risk Managed ETF (NYSE ticker: PRAY) is an example of a fund that can help address food insecurity. PRAY seeks to identify sustainable long-term growth opportunities through investing in companies that aim to benefit society and act as responsible citizens, while maintaining business practices that align with Christian values. Whatever you decide to do, the people of Ukraine need help. We believe it is our Christian duty to provide it.

Related Topics

In this episode, Jay Peroni, CFP discusses what it means to invest from a Christian worldview. He shows ways you can invest in companies that are aligned with your values (Biblically Responsible Investing). He also covers how you can create a biblically sound legacy – leaving more to ministries and your loved ones. How can you be a better steward with the wealth entrusted to you? Tune in to this week’s episode!

In this episode, Jay Peroni, CFP highlights one of the greatest challenges facing today's retirees and pre-retirees - uncertain economic times and preventing life-changing market drawdowns. He shares some biblical wisdom on how to approach the markets. What if you retired today, how do you protect and grow your assets, so you don't run out of money? Jay tackles some specific strategies to help you make sure you have a solid plan to retire, and more importantly, stay retired!